A Kentucky legislator has filed a bill that would exempt the state’s religious institutions, including churches, from having to collect the sales tax on some transactions.

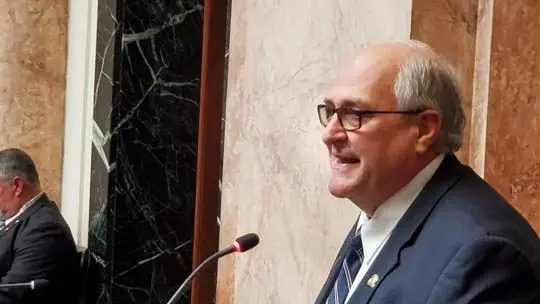

Rep. James Tipton, R-Taylorsville, unsuccessfully sponsored a similar bill during the 2025 session that would have exempted all non-profits. The new measure, HB 101, applies only to churches and other religious organizations.

“These are groups out there to help people. They’re trying to help people in need. They’re trying to provide ministry. They’re trying to provide services. And I just feel like this is not something that they should be subject to,” Tipton told Kentucky Today.

Tipton also pointed to the administrative burden on churches.

“I think a lot of people aren’t even aware they’re supposed to do this,” he said. “If you have a meal and just accept donations you don’t have to collect the sales tax on that. But if you have to charge, say $10, you’re supposed to collect that sales tax on that.

“I think it’s a detriment to our groups that are out here trying to provide ministry to help people, and from a ministry, from an administrative standpoint, I just don’t think it’s practical.”

Some opponents of the previous bill argued that exempting non-profits from collecting the sales tax would give them an unfair advantage over private restaurants and sports leagues. Tipton does not believe that is a valid argument, especially when the exemption applies only to religious institutions.

“At a lot of these churches, their members are going to be coming there anyway to the church event,” he said. “I don’t think somebody’s going to pick a church event over a restaurant just because of this. I don’t think that’s really a valid argument.”

Tipton said the impact on the $16 billion state budget would be negligible.

“I realistically don’t think we’re going to be losing that much money, because I don’t think we’re collecting that much now,” he said. “Groups just aren’t aware of this provision in the law.”

Messengers to the 2025 Kentucky Baptist Convention Annual Meeting passed a resolution urging the General Assembly to deal with the sales tax issue.

The resolution reads, in part, “…we urge the 2026 Kentucky General Assembly to pass legislation eliminating the sales and use tax burden on churches, protecting religious liberty, and ensuring that the church can reach as many people as possible with the good news of Christ free of government interference.”

“Kentucky Baptists have clearly spoken on this,” said KBC Executive Director Todd Gray. “We certainly pray that the legislature will do the right thing and acknowledge the unique role that churches play in their communities and remove this unnecessary burden to ministry.”

Tipton said he is hearing support for the bill from many of his House colleagues.

“I’ve had many people ask me to be a co-sponsor. I know we had a lot of co-sponsors last year, so I anticipate there’ll be a lot of co-sponsors.”

Tipton thinks his proposal might become part of the larger budget bill.

“I think this could be part of the revenue bill. So, I doubt that this bill would be a passed as a standalone,” he said, “I’m hoping we can get enough support, possibly to get it included with another piece of legislation and get it into law this year.”

Tipton said Kentucky Baptists and other supporters can help get the measure across the finish line.

“Reach out to your representatives and senators. Especially reach out to the leadership in the House and the Senate, because they make a lot of decisions on this — and our [budget] chairs in the House and the Senate,” said Tipton. “Just make your voice heard and let them know you support this measure and why you think it’s important.”

Constituents can leave a message for their House and Senate members by calling the Legislative Message line (800) 372-7181.

(Photo: State Rep. James Tipton, R-Taylorsville, courtesy of Kentucky Today)

By Lawrence Smith, Kentucky Today